Share

In this latest episode from Sophus3’s Automotive Digital Summit 2023 we share unique research and insight into the digital strategies of the Chinese brands now entering the European car market.

Transcript:

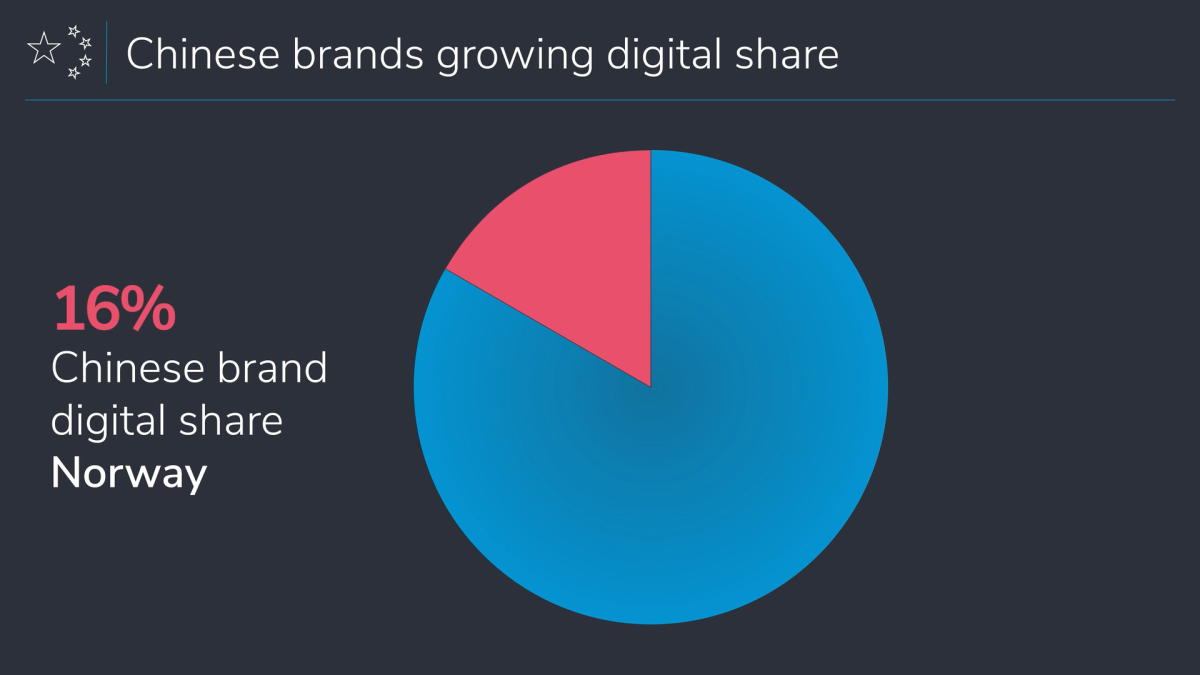

There’s been much speculation about the route to market for Chinese car brands, who are turning their attention to Europe as growth stalls in China. We analysed 14 Chinese origin car brands across nine European markets and found that Sweden had the most Chinese brands active in digital, with the Netherlands, Germany and Denmark also strongly represented. Our research showed that the majority of Chinese challengers favoured dealer networks over a direct-to-consumer model, recognising the need to establish credibility and awareness before turning to e-commerce. Key brands include Geely, Chery, NIO, BYD and XPeng, some offering vehicles under €25,000, a price advantage of between €5,000 and €10,000 over traditional brands. Brand awareness is already accelerating, and our data revealed that Chinese brands had an amazing 16% of the digital audience in Norway at the end of last year.

However, most Chinese brands are not yet getting digital right. Less than half the brands with ambitions to come to Europe have a live website and of those that do, most are basic. Less than 50% have a configurator, with the next most common features being dealer locators, subscriptions and test drives. Most did not have live chat, finance or e-commerce. The established brands in Europe have always been brilliant at building on their product advantage, making new cars that stay one step ahead of the disruptors. But now they must build on their two decades of digital experience and apply the same commitment and creativity to the customer-direct relationship.

You can read Sophus3’s white paper in full by following these links:

Our video is accompanied by our annual white paper on the automotive digital landscape, Digital Car Buyer in Numbers 2023.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

To understand how your brand truly competes online, contact Sophus3 head of insight, Patrick Fuller: patrick.fuller@sophus3.com